Diversified vs. Concentrated Portfolio: Which Strategy Am I Using?

Table of Contents

Toggle

💬 Introduction

When it comes to investing, there’s one debate that never gets old:

“Should I spread my investments across many companies?”

Or

“Should I double down on a few I really believe in?”

This question lies at the heart of every investor’s strategy — and today, I’m sharing where I stand, with a real look into my portfolio.

🧠 The Classic Saying: Eggs in Baskets

You’ve likely heard:

“Don’t put all your eggs in one basket.”

It’s the golden rule of diversification — spread your risk, protect your capital. It’s ideal for beginners and long-term investors who prefer safety and stable growth.

But then there’s the other side…

“Put all your eggs in one basket and watch it closely.”

— Warren Buffett

This is the concentrated portfolio mindset. You go deep, not wide — focusing on a few companies you understand and believe in, with the potential for big gains.

⚖️ So, Which One is Better?

Let’s compare the two:

| Diversified Portfolio | Concentrated Portfolio |

|---|---|

| Lower risk | Higher potential reward (and risk) |

| Slower but more stable returns | Faster growth if you’re right |

| Great for beginners or passive investors | Best for advanced investors who research deeply |

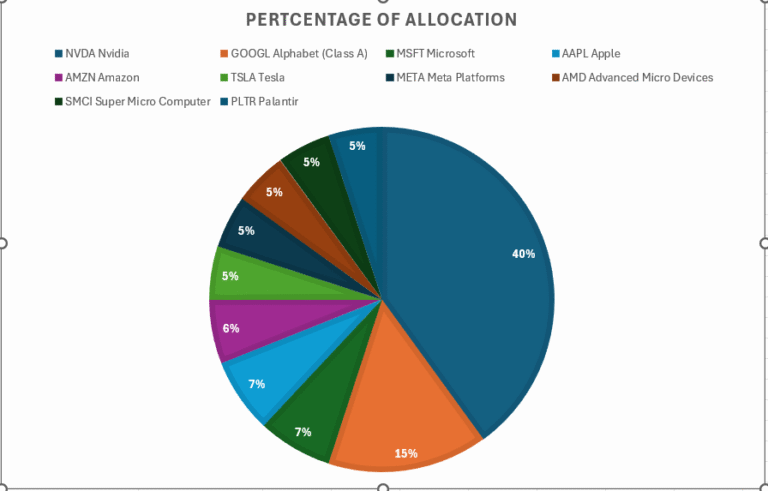

📊 My Real Portfolio Strategy

Right now, I follow a hybrid approach — mixing both strategies based on my conviction and risk appetite.

Here’s my portfolio breakdown:

40% in NVIDIA – This is my high-conviction stock. I believe in its future in AI and computing.

30% across 9 diversified large-cap Tech stocks – Stable companies across various sectors.

30% in 15 penny stocks – High risk, but small amounts that I’m willing to lose in exchange for potential upside. I believe in assymetric investment where the downside is limited up upside has no bars.

This blend lets me protect my money while also giving room to grow and learn.

🧭 Advice for Beginners

If you’re starting out, here’s my simple advice:

Start with diversified ETFs or index funds like VOO or Vanguard Total Market (VTI).

Gradually add individual stocks as you gain knowledge and confidence.

Don’t go all-in on penny stocks or trending names without understanding them.

Know your goals — are you investing to grow wealth, protect it, or experiment and learn?

🔚 Final Thoughts

There’s no one-size-fits-all approach.

Diversification protects.

Concentration magnifies.

The trick is to know yourself. My portfolio isn’t perfect — but it reflects my current journey: learning, growing, and aiming for financial freedom.

If you’re willing to do deep research and stomach volatility, some concentration may suit you.

If you prefer a safer, more passive approach, diversification wins.

In the end, your portfolio should reflect your risk tolerance, knowledge, and long-term goals.

Let me know in the comments:

Which strategy do you prefer? Diversified or concentrated? Or do you use a mix like me?